nebraska sales tax percentage

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. There is no applicable county tax city tax or special tax.

Ainsworth 15 70 07 52-003 00415 Albion 15 70 07 81-004 00555 Alliance 15 70 07 27-008 00905 Alma 20 75 075 82-009 00975 Ansley 10 65 065 234-015 01535 Arapahoe 10 65 065 157-016 01780 Arcadia 10 65 065 192-017 01850 Arlington 15 70 07 206-018 01990 Arnold 10.

. Nebraska Sales Tax Rate Finder. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

In overall tax burden Nebraska has become a high tax state. The 2018 United States Supreme Court decision in South Dakota v. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. The Nebraska NE state sales tax rate is currently 55. You can print a 55 sales tax table here.

The Nebraska state sales and use tax rate is 55 055. This is the total of state county and city sales tax rates. The Nebraska state sales and use tax rate is 55.

The base state sales tax rate in Nebraska is 55. The Nebraska NE state sales tax rate is currently 55. So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location.

Did South Dakota v. How much is sales tax on a car in Nebraska. You can find these fees further down on the page.

The County sales tax rate is. Nebraska Sales Tax Rate The sales tax rate in Nebraska is 55. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. Groceries are exempt from the Nebraska sales tax Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. We are ranked near the top third both per capita and as a percent of personal.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Exemptions from sales tax in Nebraska include groceries prescription medications and most medical equipment. Local Sales and Use Tax Rates.

How to Register for Nebraska Sales Tax. All concession sales of prepared food are taxable except those made by elementary and secondary schools. Lower sales tax than 50 of Nebraska localities 2 lower than the maximum sales tax in NE The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska has state sales tax of 55 and allows local.

While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. The Nemaha sales tax rate is. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 25 across the state with an average local tax of 0547 for a total of 6047 when combined with the state sales tax.

Nebraska has a state sales and use tax rate of 55. Additionally city and county governments can impose local sales and use tax rates of up to 2. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

Find your Nebraska combined state and local tax rate. Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate. Has impacted many state nexus laws and sales tax collection requirements.

Nebraska is a destination-based sales tax state. Sales Tax Rate s c l sr. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

The Nevada sales tax rate is. Five states have no sales tax. Is food taxed in Nebraska.

With local taxes the. Wayfair Inc affect Nebraska. Food and prescription drugs are exempt from state sales tax.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Nebraska Department of Revenue. Nebraska has a state sales tax of 55 percent for retail sales.

Concessionaires are permitted to. Colorado has the lowest sales tax at 29 while California has the highest rate at 725. For tax rates in other cities see Nebraska sales taxes by city and county.

The minimum combined sales tax rate for Las Vegas Nevada is 838. 31 rows The state sales tax rate in Nebraska is 5500. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska NE state sales tax rate is currently 55. The Nebraska sales tax rate is currently.

The Nebraska state sales and use tax rate is 55. For vehicles that are being rented or leased see see taxation of leases and rentals. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Is Nebraska a high tax state.

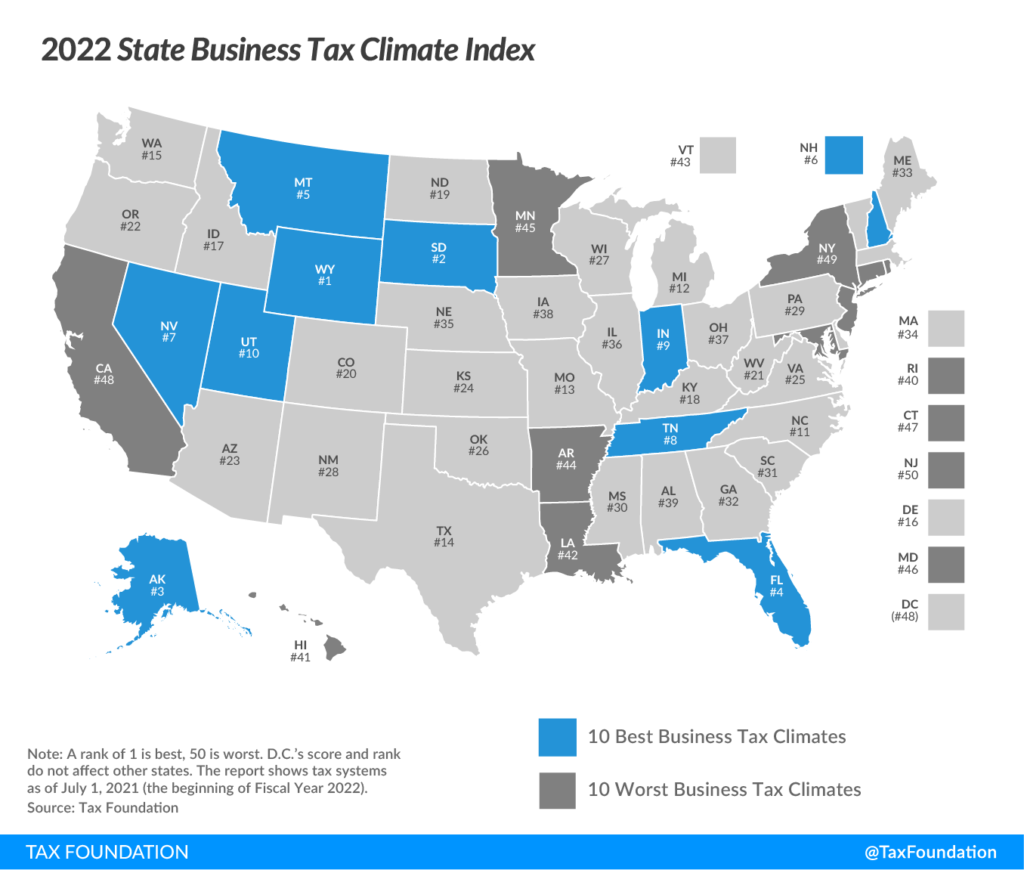

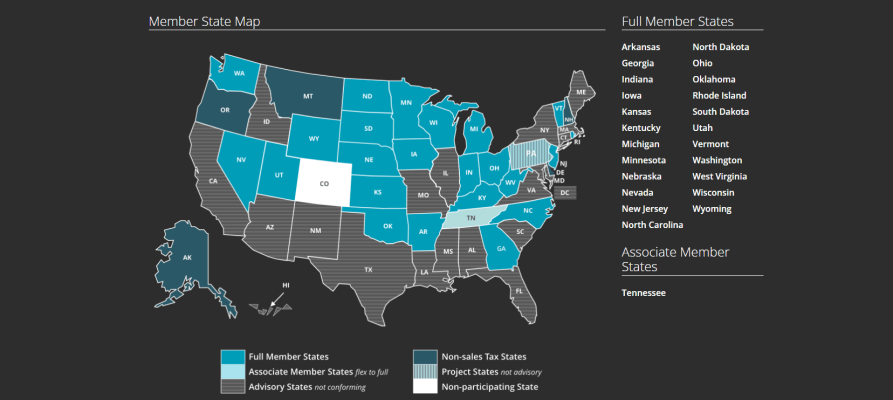

Nebraska Drops To 35th In National Tax Ranking

Sales Taxes In The United States Wikiwand

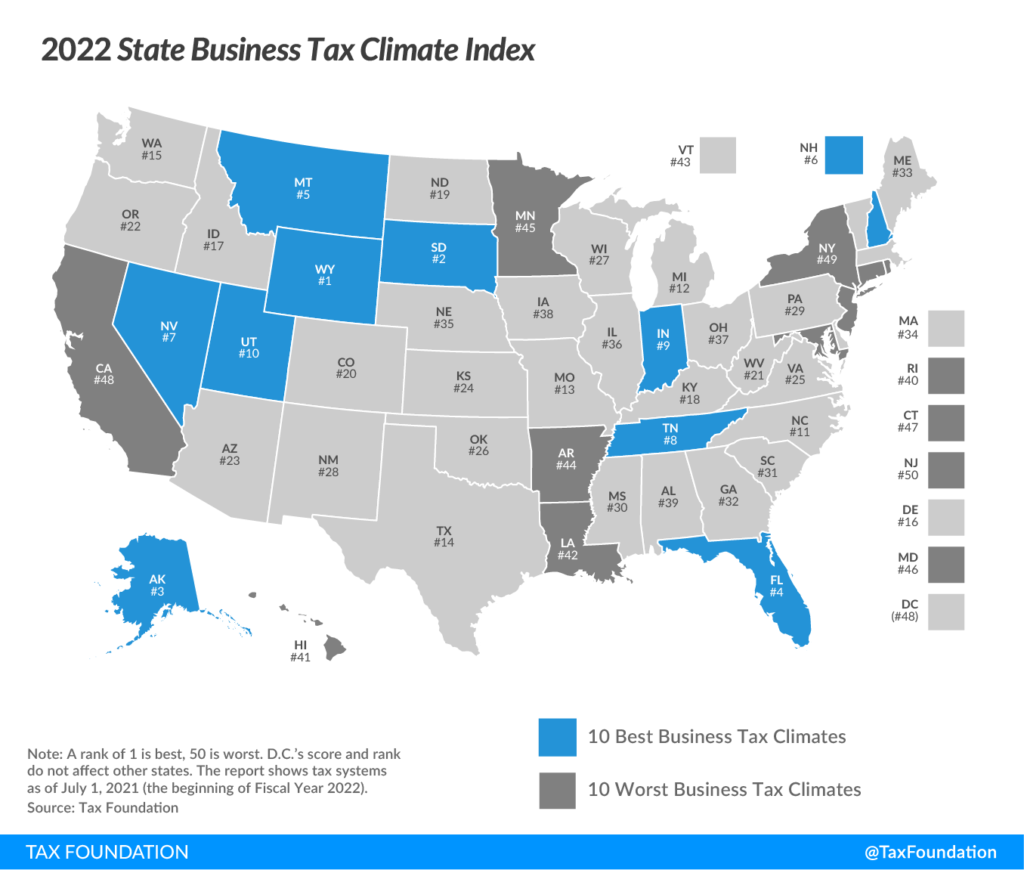

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

States With Highest And Lowest Sales Tax Rates

Nebraska Sales Tax Rates By City County 2022

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Rates 2000 2017 Tax Policy Center

Nathan Madden On Twitter Healthy Kids Grocery Kansas

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

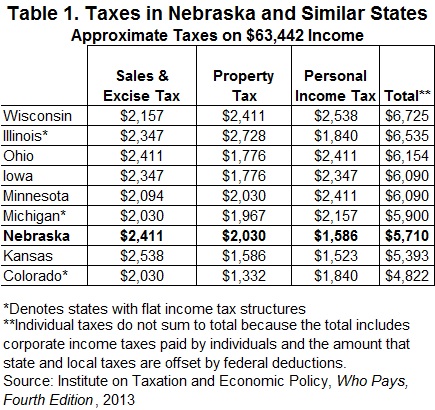

Streamlined Sales Tax Free Online Sales Tax Solution Ledgergurus

How Is Tax Liability Calculated Common Tax Questions Answered

Ranking State And Local Sales Taxes Tax Foundation

Taxes And Spending In Nebraska

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Updated State And Local Option Sales Tax Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return