do nonprofits pay taxes on investment income

Internal Revenue Code Section 4940 imposes an excise tax on the net investment income of most domestic tax-exempt private foundations including private operating foundations. Given their status as a.

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

The tax rate on capital gains for most assets held for more than one year is 0 15 or 20.

. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for.

However Private Foundations will pay tax on. In general 501c3 charities do not pay tax on capital gains. Form 990-EZ which is a much shorter version of the main form is for.

Compensation for Staff Members. Up to 25 cash back While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both. This guide is for you if you represent an organization that is.

Even tax-exempt nonprofits sometimes earn taxable income. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Do nonprofits pay taxes.

The major sub-sectors where investment income exceeds 5. Do nonprofits pay income tax on investments. Monday April 25 2022.

In short the answer is both yes and no. An agricultural organization a board. Tax-exempt organizations report their income from stock investments on Form 990 which is the annual informational return tax-exempt organizations must file.

Capital gains taxes on most assets held for less than a year correspond to. Investment Income Tax Exempt Income from dividends interest annuities payments on. In a nutshell nonprofits can make up to 1000 of unrelated income before they have to pay taxes on it.

Tax on Net Investment Income. UBI can be a difficult tax area to navigate for non-profits. When your nonprofit incurs debt to acquire an income-producing asset the portion of the income or gain thats debt-financed is generally taxable UBI.

Non-profit Tax-Exempt Status. This is partly due to. The full Form 990 is for non-profit organizations with gross receipts greater than or equal to 200000.

For the most part nonprofits are exempt from most individual and corporate taxes. Perhaps the most impactful investment characteristic of a non-profit organization is its tax-exempt status. But determining what are an.

And the IRS doesnt treat profits the nonprofit earns from investments differently than other donations. What Taxes Do Non-Profits Pay. If a nonprofit runs an unrelated business to raise money -- one thats not part of the core mission -- the unrelated.

Employee wages and benefits are some of the most common and important deductions to include on a tax return. Which Taxes Might a Nonprofit Pay. While nonprofits can usually earn unrelated business income without jeopardizing.

Our reference tool explains UBTI Federal income taxes Donations Federal unemployment tax Taxes on financing and more. Do nonprofits pay taxes on investment income. Many nonprofits hold stocks in their endowment accounts.

Excluding foundations one in five nonprofits receives at least 5 percent of its income from investments. Answer 1 of 5. Anything more will require the nonprofit to pay both state and federal.

Tax-exempt organizations are eligible to make investments in stocks bonds and other financial instruments. There are certain circumstances however they may need to.

How To Give To Charity In The Most Tax Effective Way

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

Refund Of Capital Gains Tax On Investment Income In Germany

Capital Budgeting And Capital Accounting Systems Management Guru Budgeting Tools Budgeting Budget Forecasting

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Tax Efficient Investing Guide Tips Account Types Seeking Alpha

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Nonprofit Project Budget Template Seven Doubts About Nonprofit Project Budget Template You S Budget Template Budgeting Worksheets Budgeting

What Are Tax Sheltered Investments Types Risks Benefits

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

Are 501c3 Stock Investment Profits Tax Exempt Turbotax Tax Tips Videos

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Worker Cooperative Economics Cooperation

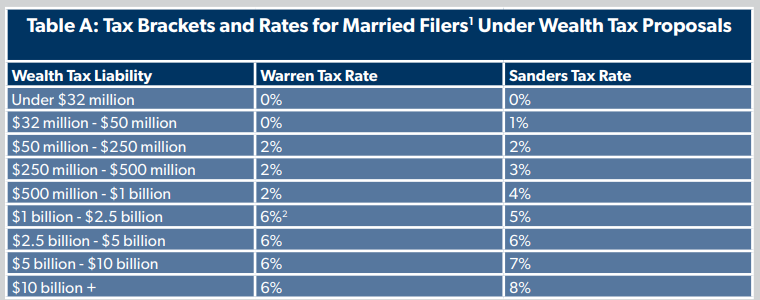

The Wealth Tax S Impact On Private Charities Foundation National Taxpayers Union

Why Should Nonprofits Consider Using An Operating Measure

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

Private Foundations And The Excise Tax On Net Investment Income